Subject: txt mny - msm - The Federal Reserve of Minneapolis has posted a series of charts comparing the current recession -- as defined by the National Bureau of Economic Research, to previous recessions dating back to the end of World War II.

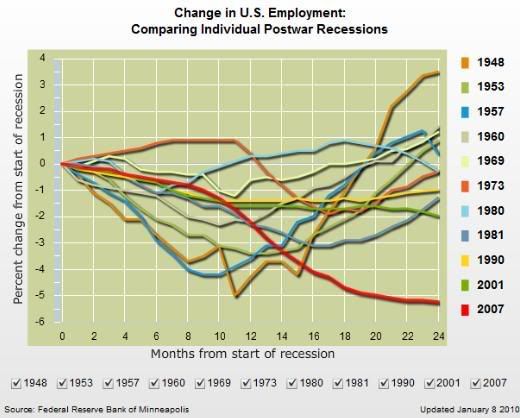

The Federal Reserve of Minneapolis has posted a series of charts comparing the current recession -- as defined by the National Bureau of Economic Research, to previous recessions dating back to the end of World War II.

The charts definitely show how utterly wrong reporters like the Associated Press's Jeannine Aversa are when they claim that there has been anything resembling a "rebound" since the economy hit bottom from a growth standpoint in the second quarter of 2009 (the economy has yet to see an employment bottom).

They also explain why AP reporter Martin Crutsinger seems to have tired of trying to put a "getting better" face on things in the past couple of days (as seen here and here).

Here are the two mind-numbing creations in question, the first showing changes in output (GDP) and the second showing changes in employment:

Morrissey's capsule summary:

"The economic policies of the Obama administration have lengthened the recession and delayed what would be the normal recovery process, mainly by signaling to investors and businesses that costs will go up in taxes and energy prices, as well as burdensome mandates on health insurance. As a result, people are not investing their money into job-creating risk but are sheltering their cash instead."

The Obama administration's "Uncertainty Economy" continues to wreak absolute havoc.

Given what the first stimulus hasn't accomplished, any serious attempt at a second stimulus that based on history going back to the 1930s would be just as ineffective will have to call into question whether our government really wants the economy to recover.

In the meantime, I hope the folks at the Minneapolis Fed aren't waiting by the phone for calls from establishment media journalists requesting explanations and clarifications. They'll be pretty lonely if they are.

READ MORE

mage toon = mny = White house wrecking economy-jobs

No comments:

Post a Comment