Starting Wednesday, California's sales tax rose to 6 percent, bringing the average local sales tax rate to almost 9 percent -- one of the highest in the nation.

In the coming months, Californians will also see an increase in personal income taxes and higher fees to license their vehicles.

- Gov. Arnold Schwarzenegger and lawmakers agreed to $12.5 billion in tax increases as part of a $42 billion deficit-closing plan to help stave off what they described as devastating cuts to education and health care.

- State officials predict consumers will spend less because of the tax, and included a 1 percent reduction in their revenue calculation.

- Besides a higher sales tax, the state will impose a.25 percent increase in the personal income tax rate in the 2009 and 2010 tax years and a.5 percent increase in fees to license vehicles from this May.

- A fourth tax increase reduces the dependent care credit parents and caregivers can claim to $99 from $309 for the 2009 and 2010 tax years.

Steve Levy, director and senior economist of the Center for the Continuing Study of the California Economy, described the package of higher taxes as a shift in wealth from the private sector to the public [government] sector.

Businesses and manufacturers are worried that the tax increase could prolong the worst recession in recent memory and further dampen retail sales.

READ MORE

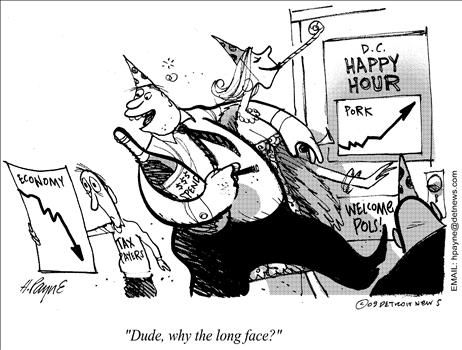

image toon - 1st mny - DC Dems to taxpayer: why long face

No comments:

Post a Comment