President Obama's budget proposes $989 billion in new taxes over the course of the next 10 years, starting fiscal year 2011, most of which are tax increases on individuals.

1) On people making more than $250,000.

$338 billion - Bush tax cuts expire

$179 billlion - eliminate itemized deduction

$118 billion - capital gains tax hike

Total: $636 billion/10 years

2) Businesses:

$17 billion - Reinstate Superfund taxes

$24 billion - tax carried-interest as income

$5 billion - codify "economic substance doctrine"

$61 billion - repeal LIFO

$210 billion - international enforcement, reform deferral, other tax reform

$4 billion - information reporting for rental payments

$5.3 billion - excise tax on Gulf of Mexico oil and gas

$3.4 billion - repeal expensing of tangible drilling costs

$62 million - repeal deduction for tertiary injectants

$49 million - repeal passive loss exception for working interests in oil and natural gas properties

$13 billion - repeal manufacturing tax deduction for oil and natural gas companies

$1 billion - increase to 7 years geological and geophysical amortization period for independent producers

$882 million - eliminate advanced earned income tax credit

Total: $353 billion/10 years.

READ MORE

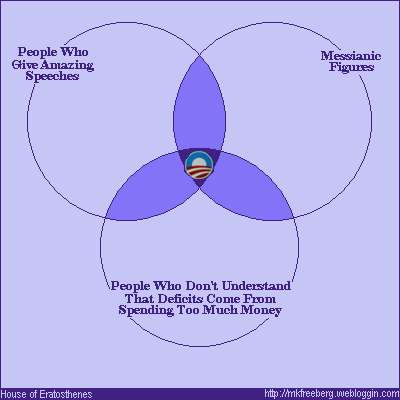

[Or, to explain this budget in graphical terms:

Friday, February 27, 2009

Obama's Budget: Almost $1 Trillion in New Taxes

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment